As you approach the age of 65 while still working, you may be considering the benefits of Medicare compared to your employer’s group health coverage. One of the most common questions we get from customers is, “How does Medicare affect HSAs?”. We’ll outline what the different parts of Medicare mean for Health Savings Account contributions, and how to weigh the decision between enrolling in Medicare while working.

An HSA is a tax-advantaged savings account designed to help individuals with high-deductible health plans (HDHPs) save for medical expenses. Contributions made to an HSA are tax-deductible, earnings grow tax-free, and withdrawals used for qualified medical expenses are also tax-free.

You can think of this as a special savings account just for medical expenses. These qualified expenses includes things like doctor visits, prescriptions, and even some dental and vision care. Because these are only available in high-deductible health insurance plans, it means you’ll pay more out of pocket before your insurance kicks in.

Medicare Part A (Hospital Insurance) is considered a form of health coverage, and according to IRS regulations, individuals who have Medicare Part A are not allowed to contribute to an HSA. This means that if you choose to enroll in Medicare Part A, you will no longer be eligible to contribute to your HSA. However, if you have an existing HSA, you can continue to withdraw funds from it to cover qualified medical expenses.

If you are still working and your employer contributes to your HSA, you need to be aware that once you enroll in Medicare Part A, your employer can no longer contribute to your HSA. This applies regardless of whether you continue to work or not. Therefore, it’s important to consider this aspect when making decisions regarding Medicare enrollment.

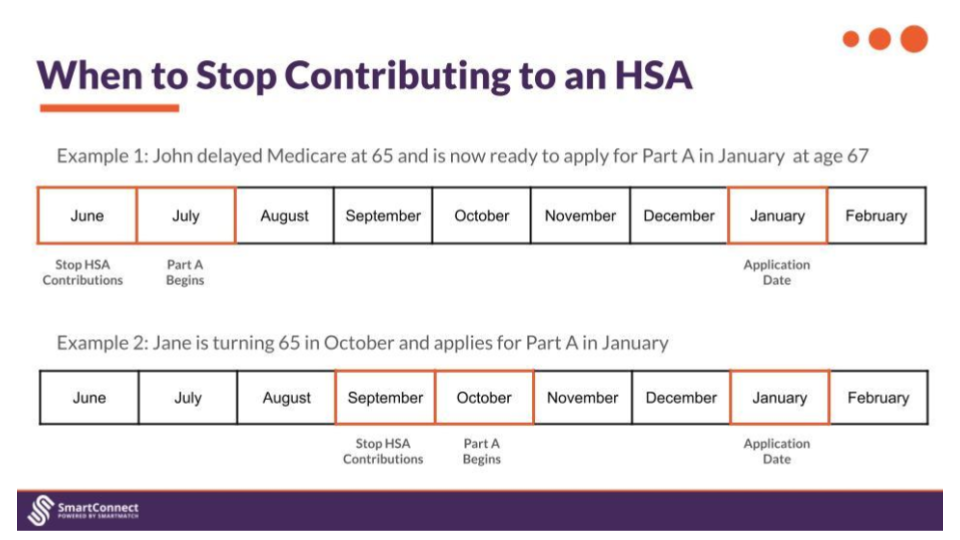

The 6-month backdating rule is important to know, as this is the specific time period in which you have to stop contributing to your HSA — even before you actually apply for Medicare Part A or Part B. This is because Medicare Part A coverage is backdated six months. If you continue to contribute to your HSA during this time period, you could face tax penalties.

If you wish to continue contributing to your HSA and want to delay your Medicare Part A enrollment, you must meet specific requirements. Firstly, you need to be eligible for Social Security benefits but have not filed for them yet. Secondly, you must actively decline Medicare Part A coverage. By doing so, you can maintain your HSA eligibility and continue contributing to it until you decide to retire or stop working.

Medicare Part B (Medical Insurance) is optional and covers services such as doctor visits, outpatient care, and medical supplies. However, enrolling in Medicare Part B generally disqualifies you from contributing to a Health Savings Account (HSA). This is because to be eligible for an HSA, you must not have any other health insurance coverage besides a high-deductible health plan (HDHP), and Medicare Part B is considered other insurance.

Note: You can’t use HSA funds to pay for Medigap premiums.

It is important to note that if you enroll in any Medicare prescription drug coverage (Part D), you are no longer eligible to contribute to your HSA. Medicare Part D is considered creditable prescription drug coverage, which means that having it disqualifies you from contributing to your HSA. However, you can still use your existing HSA funds to cover prescription drug expenses.

Enrolling in Medicare can have implications for your Health Savings Account, depending on the specific Medicare parts you choose to enroll in. It is crucial to carefully consider your options, taking into account your current HSA contributions, employer contributions, and medical coverage needs to make an informed decision that aligns with your financial goals and healthcare requirements.

120 W. 12th St.

Suite 1700

Kansas City, Mo. 64105

Mon.- Fri. 7:30 am - 5 pm CT