HR Assets

Beneficiary Asset Library

See Beneficiary section below for more information about the assets included in this library. Please put all beneficiary-facing assets on your intranet, in your benefits guides, your HR portal, etc. Anywhere your people have easy access to!

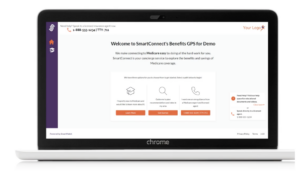

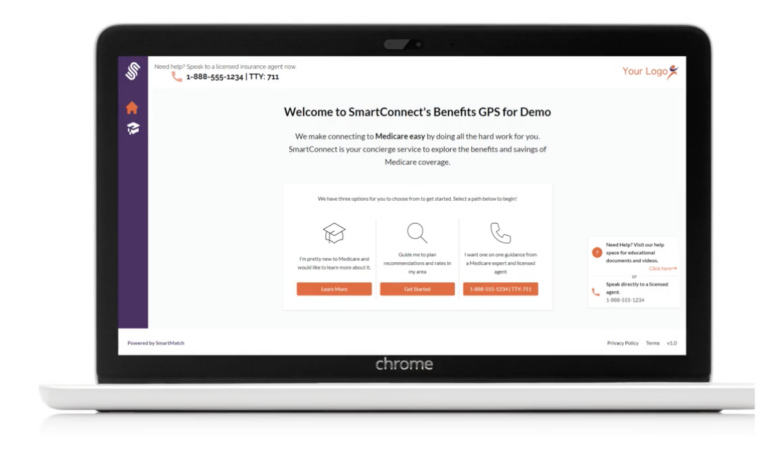

Benefits GPS Tool

This user-guided digital experience allows users to see plans and rates available in their area. Beneficiaries will be able to reach a licensed insurance agent by phone or by filling out the online questionnaire. Be sure to share your unique URL with your employees via your benefits guide, intranet, etc.

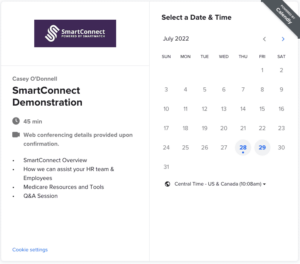

Calendly

Calendly is the tool you'll use to schedule meetings with your Account Manager. You will see a Calendly link in several emails from your Account Manager — it's the easiest way to set up time to speak with us!

Census Specs Doc

This document provides your employee census file data requirements to ensure a successful upload.

Census Template

Use this template when building your census file to ensure a successful upload. It will show you exactly how to format the data.

Getting Started with SmartConnect - HR

This two-page resource provides HR teams with quick information about SmartConnect, who can use it, how much it costs, and how to speak to employees about the program.

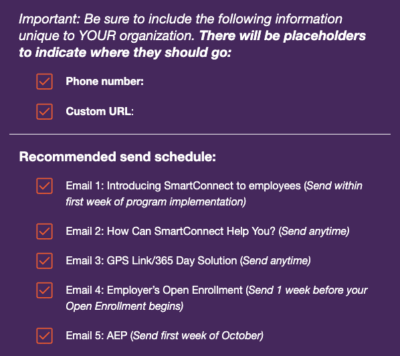

Emails: Partner Outreach

These emails are sent by HR teams to their employees. We provide the recommended content including your unique phone number, Benefits GPS URL, and even provide suggested send dates. These emails are important because they are sent from the company to its employees to build trust in the program. They can be sent using any email service provider.

HR/Benefits Brochure

This resource serves as a training document for your benefits team. It covers a SmartConnect program overview, how we work with your HR team, how SmartConnect can help, how the process works, Medicare eligibility, and more.

HR Portal

Use the HR portal to access/download your co-branded marketing materials and upload Census data (Active+ solution only). A username and password is required to access the portal.

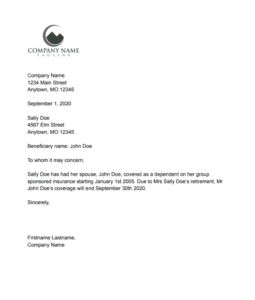

Involuntary Guaranteed Issue "GI" Letter

This is a sample letter of what an insurance company may request for a previous employee that has INVOLUNTARILY (i.e. termination) lost access to the group-sponsored insurance.

Voluntary Guaranteed Issue "GI" Letter

This is a sample letter of what an insurance company may request for a previous employee that has VOLUNTARILY (i.e. resignation) lost access to the group-sponsored insurance.

Marketing Calendar/Strategy

This document provides insight into SmartConnect Marketing strategy and timelines for the year. This document should not be shared with beneficiaries.

Phone Number

This phone number is either unique to your associated parent company (Passive solution) or to your organization (Active and Active+ solution) and is directed to a SmartConnect licensed insurance agent. It is important this number is included on all marketing materials or internal communications to ensure tracking is accurate and tied to the corresponding organization — and most importantly, that your people get an optimal experience.

QR Code

This QR code gives beneficiaries easy access to the Benefits GPS Tool. We recommend including it on any internal communications to employees.

Solutions Walkthrough Videos

Not sure where to start? Schedule a program overview with your SmartConnect Account Manager or click below to access our library of helpful videos.

Getting Started Checklist

Step 1: Send partner outreach email No. 1 - "Introducing SmartConnect to Employees"

We recommend sending the "Introducing SmartConnect" email to your employees within the first week of being onboarded. Please be sure to attach the "Introducing SmartConnect" brochure.

Step 2: Add GPS URL and/or QR Code to intranet and benefits materials

This boosts engagement and awareness around our partnership with employees. Remember — we offer Medicare advocacy to all employees, not just those who are Medicare-eligible.

Step 3: Use provided Medicare 101 template and send to all employees

You may have employees that think they've already evaluated their Medicare options and don't need to consider the current benefits of enrolling in Medicare. This guide and video offer an easy-to-understand overview of the potential additional benefits and cost savings they may be missing out on.

Step 4: Upload census data

Active+ solution only, census deadlines will be communicated to each partner.

Continuing The Conversation Tips

Step 5: Continue to follow partner outreach email send schedule

Remember: you are the first and MOST important introduction your employees have to SmartConnect. Please help us to make sure your employees know who we are, what we do, and who we help (even friends and family)!

Step 6: Virtual benefits fair? Include us!

Pro Tip: Including your SmartConnect GPS QR code and unique phone number in your Benefits Guide.

Step 7: Stay Involved!

Please keep an eye out for continual communications from SmartConnect. Especially at the end of the year when we ask you to update employee headcount and your group benefits information

Beneficiary Assets

Benefits GPS Tool

Our user-guided digital resource lets people view plans and rates available in their area. Beneficiaries can contact a licensed SmartConnect insurance agent by calling the phone number listed or filling out the questionnaire.

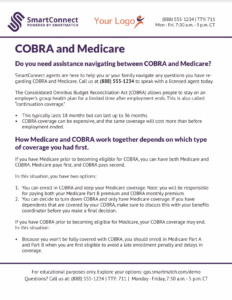

COBRA and Medicare

This resource highlights the coordination of benefits between Cobra and Medicare and describes the crucial enrollment periods for Part B (Medical) and Part D (Prescription). We recommend including this document in exit packages and retirement information.

Introducing SmartConnect Guide

This introduces the SmartConnect program including what it is, how we help, information about SmartMatch Insurance Agency, a high-level comparison of Medicare Supplement and Medicare Advantage plans, key considerations when choosing a plan type, and the SmartConnect process. We recommend you attach this brochure on your first Partner Email send when introducing SmartConnect to your organization.

Medicare 101 Guide

This introduces the SmartConnect program including what it is, how we help, information about SmartMatch Insurance Agency, a high-level comparison of Medicare Supplement and Medicare Advantage plans, key considerations when choosing a plan type, and the SmartConnect process. We recommend you attach this brochure on your first Partner Email send when introducing SmartConnect to your organization.

Medicare 101 Webinar

This brief, informative video is hosted by two of SmartConnnect's Medicare experts and can be viewed at any time. The webinar covers all the basics, including:

1. Enrollment in Original Medicare (Part A and Part B).

2. Introduce your options for covering the coverage gaps.

3. Medicare Supplement and a stand-alone prescription drug plan (Part D)

4. Medicare Advantage Plan (Part C)

Getting Started with SmartConnect - Beneficiary

This one-page resource provides employees with high-level information about SmartConnect including what it is, who can use it, how much it costs, and when the right time is to call. We recommend this quick-hitting asset is printed for display or shared digitally wherever benefits are mentioned!

Medicare While Working Guide

This guide was designed for Medicare-eligible adults who are working beyond age 65. Readers will learn about 7 surprising facts they need to know about Medicare while working.

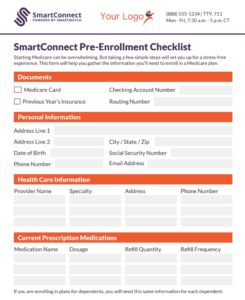

Pre-Enrollment Checklist

This simplifies the enrollment process by outlining the information needed to enroll in a Medicare plan. We recommend beneficiaries complete this checklist prior to their initial phone consultation to ensure efficiency and accuracy.

Retiree Brochure

This resource serves as an informational jump-start into Medicare for retirees. It includes 5 helpful steps and tips as well as a copy of the pre-enrollment checklist. We recommend including this document in exit packages and retirement information.

What To Expect

Step 1: Connect

First, we get to know you. We ask basic questions about your health insurance needs and preferences, so we can identify the right path.

Step 2: Educate

Next step is ensuring they understand the details that could impact their enrollment, cost, and coverage.

Step 3: Evaluate

Then, we provide curated plans and carrier options available to them.

Step 4: Enroll

While our services are obligation-free, if they find something they like and they're ready switch, we can enroll them on the spot.

Step 5: Support

We have a team who is dedicated to the beneficiary's ongoing Medicare experience. They're available to answer questions, conduct policy reviews, and even help them work with their plan's provider when necessary.